Budget Breakdown: Key Considerations for the R&D Tax Incentive

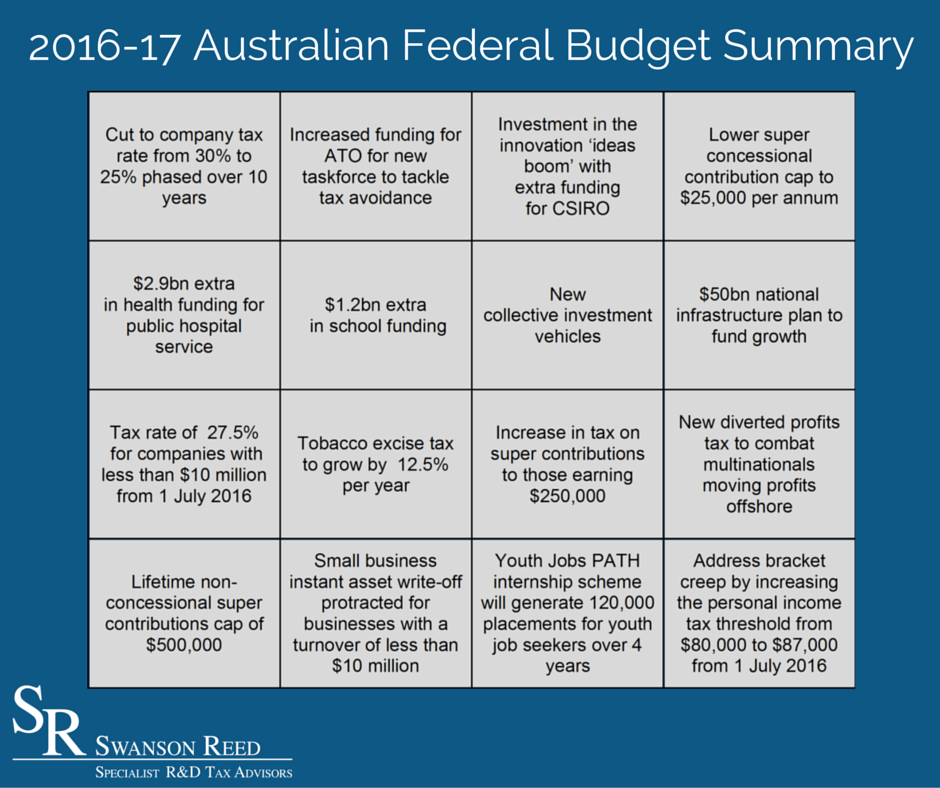

May 4th, 2016Over the last twelve months there has been substantial activity in respect to the research and development (R&D) tax incentive with various announcements broadcasted by the government and a declaration of a review of the programme. As a result, the discourse of business and government in Australia is rife with mentions to innovation, disruption and dexterity. Last night, the treasury announced the 2016-2017 budget, signifying a major step in making Turnbull’s innovation goals a reality. In light of this, the key aspects of budget have been outlined in the infographic below.

Overall, the 2016-17 budgets mostly encompasses policies revealed in last year’s $1.1 billion innovation statement. The budget encompasses a $9.2 billion package of reforms across company tax, small business and personal income tax. The policies include tax incentives for early-stage start up investment, an expansion of the CSIRO’s accelerator program, changes to the employee share scheme and reforms to the equity crowdfunding reforms.

Notably, the measures include raising $4.7 billion over four years from tax on tobacco, which will assist in funding further tax cuts for small business and an effective income tax cut for middle Australia. For instance, a key measure outlined in the budget is is lifting the 32.5% tax level threshold to $87,000, up from $80,000, removing 500,000 taxpayers from the 37% second top marginal tax rate. Furthermore, under a 10-year plan the corporate tax rate will be reduced for all companies from 30% to 25%. From 1 July, the small business tax rate will be cut by 1% to 27.5% and the turnover threshold for small businesses able to access a reduced tax rate will be increased to $10 million (currently companies under $2 million tax rate of 28.5%).

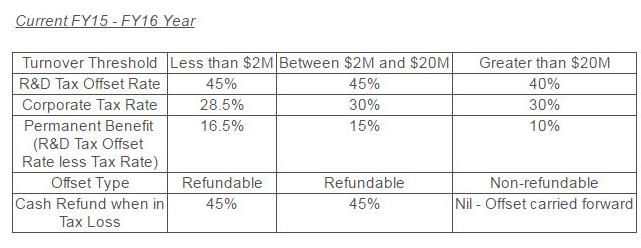

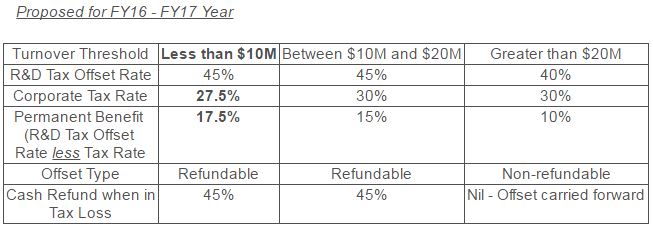

Swanson Reed notes that there did not appear to be any direct changes proposed to the R&D tax incentive within the budget, however the relative value of the R&D tax incentive is affected by any movement in the corporate tax rate, as outlined below:

Whilst the above reflects the interaction between the current legislated rate of R&D tax offset and proposed changes to the corporate tax rate, we anticipate that there may be future proposed reductions to the R&D tax offset rate. This would restore the relative permanent benefit of the R&D tax incentive. Such future changes to the R&D tax incentive may also include recommendations arising from the current review of the programme.

In summary, Swanson Reed applauds the lower company tax rate and the government’s focus on policy initiatives to drive innovation. We call on the government to carefully consider any future proposed changes the R&D tax incentive to ensure that the relative benefit, scope of eligible activities and key eligibility thresholds are not detrimentally changed. The R&D tax incentive remains the cornerstone of Australia’s innovation system and its stability is crucial to attract and maintain business investment in Australian innovation.

If you would like to discuss the R&D tax incentive further, please do not hesitate to contact one of Swanson Reed’s offices today.

Categories

- ATO Guidance and Materials

- AusIndustry Guidance and Materials

- Case Law

- Federal Budget 2021

- Federal Budget 2022

- Federal Budget 2024

- For Accountants

- General Information

- Government Policy and Treasury

- Industry Specific Issues

- Interpretative Decisions

- Legislation and Parliamentary Matters

- R&D Tax Credit

- R&D Tax Funding Strategies

- R&D Tax Loans

- Recent News

- Tax Determinations

Archives

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- September 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- May 2013

- April 2013

- March 2013

- September 2012

- August 2012

- June 2012

Free Call: 1800 792 676

Free Call: 1800 792 676

News & Research

News & Research